Will OCA break through the stranglehold problems and usher in the dawn of domestic substitution? |JD Investment Insight

2023-08-28

JD Capital Advanced Manufacturing Research Team

Managing Director Xiaohui Xing xingxh@jdcapital.com

Investment Manager Long Suo suolong@jdcapital.com

The arduous mission of breaking the monopoly of foreign-funded giants has fallen to a niche segment - optically adhesive (Also known as OCA, Optically Clear Adhesive).

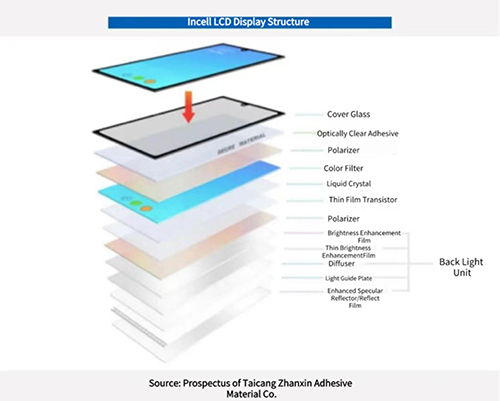

Optically clear adhesive, usually refers to the optically acrylic adhesive made into a substrate-free adhesive film, in the upper and lower bottom layer and then each laminated with a layer of release film double-sided lamination products. The die-cut optically clear adhesive is widely used in LCD touch display, AMOLED flexible display and other products, and ultimately applied to smart phones, tablet PCs, smart wearables, laptop computers, automotive and home appliance industries.

In early 2023, an enterprise whose main business is precision dust-free die-cutting of optically clear adhesive withdrew its application for listing on the Growth Enterprise Market (GEM) a year and a half after submitting it to the Shenzhen Stock Exchange and having passed the meeting. Although the company did not disclose the reason, but the core technology and GEM positioning does not match, over-reliance on suppliers and customers, performance decline and other issues, have been the focus of the regulatory layer of the company's IPO inquiries.

The company's over-reliance on suppliers and customers reflects the embarrassing situation of domestic OCA enterprises.

According to the prospectus, the company's core raw material OCA is mainly purchased from the 3M Group in the U.S. In 2019-2021, the company's purchases from the 3M Group accounted for more than 83% of the total raw material purchases. In other words, the company's lifeblood is firmly clutched in the hands of 3M.

In fact, for a long time in the past, China's OCA industry was monopolized by foreign companies.According to JD Capital's estimation, the global market size of OCA in 2021 exceeds RMB 15 billion. Foreign enterprises, including 3M of the United States, Mitsubishi Chemical of Japan, LG Chemical of South Korea and Samsung SDI, have a market share of more than 90% due to their mastery of the core technology of OCA.

However, since Chinese companies such as ZTE and Huawei experienced international trade conflicts in 2018, domestic independence and control has become a top priority in the hearts of Chinese people. The development and spread of overseas new crown epidemics in the past few years has highlighted the stability of the Chinese market and industrial chain, and to a certain extent, it has also promoted the development of the domestic high-end manufacturing industry.

Especially the 3C (i.e. Computer, Communication, Consumer Electronic, including a series of categories such as computers, tablet devices, smart phones, smart wearable devices, etc.) industry has become one of the largest single industries in the entire manufacturing industry. And China is the world's largest R&D and manufacturing base for the 3C industry.

Fortunately, policies are also encouraging the development of the optically clear adhesive industry. In the Classification of Strategic Emerging Industries (2018) published by the National Bureau of Statistics of China, optically film manufacturing has been listed as a new material industry in the strategic emerging industries.

Over the past ten years, JD Capital has invested in a large number of outstanding companies in the materials field, including Long Bai Group (002601), a manufacturer of titanium, zirconium, and lithium new materials research and development, Silicon Dioxide Industry Chain Leader QUECHEN (605183), and Aramid III Fibre and its advanced composite materials research and development company, Phaeton Technology Corporation (872505), and so on.

In this issue of JD Investment Insight,we focus on the optically clear adhesive industry and try to discuss the way to break through and the future development opportunities for domestic enterprises in light of the rise of some international giants and the current status quo.

1.Optically clear adhesive(OCA) is difficult to be replaced, Chinese companies are entering the market

According to information, optically clear adhesive was first used in aerospace products. 2007, after the release of Apple's first-generation iPhone, the touch screen became the standard for smart phones, optically clear adhesive also opened up new areas of application.

In terms of product application, optically clear adhesive can be applied to both touch screen and non-touch screen.Take touch screen as an example, the relevant screen structure from top to bottom are glass cover (CG), touch screen (TP), liquid crystal module (LCM), etc., which need to be laminated between them.

Technologies of touch screen lamination can be divided into full lamination, frame, “0”lamination three technologies:

1,Full lamination. It is a technical process of seamlessly and completely bonding different screen structures using water based adhesive (also known as liquid optically clear adhesive, LOCA) or optically clear adhesive.

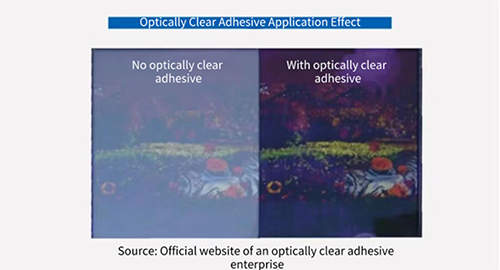

Optically Clear Adhesive has a high degree of cleanliness, high transmittance, low haze, high adhesion, no crystal points, no bubbles, water resistance, high temperature resistance, UV resistance and other advantages, and its thickness uniformity and high flatness, and glass, PC (Poly Carbonate), PMMA (Poly Methyl Meth Acrylate, also known as acrylic or plexiglass) refractive index is close to the prolonged use of the yellowing does not occur, aging, haze, detachment from the surface being stuck and the occurrence of air bubbles and other problems.

However, compared with the LOCA, the OCA full lamination process is more complicated, because it needs the intervention of the die-cutting factory. At present, many large full lamination factories (including TP factories and module factories) do not have their own corresponding die-cutting station. Therefore, the first supplier of full lamination OCA is a large and medium-sized die-cutting factory, but there are a lot of problems with the two sides.

2, Frame. Also known as the airbonding, with double-sided adhesive to the touch screen and display fixed on all sides, but there is an air layer between the display and the touch screen. The characteristics of the frame is low cost, simple application, but the display is poor.

3, 0 lamination. Its lamination between the full paste and frame, that is, between the touch screen and display, filled with refraction coefficient and glass equivalent non-adhesive transparent media. On the one hand, 0 lamination let there is no gap between the glass and the display, reduce the diffuse reflection, enhance the display effect; on the other hand, 0 lamination due to the lack of adhesion, assembly and maintenance is simple, low cost.

Among the several lamination methods mentioned above, OCA full lamination has the best display effect and the widest application.

We believe that in the next 10 years, as long as the different screen structures need to use adhesive to bond, optically clear adhesive is difficult to be replaced by other products or technologies. However, in terms of product performance, there may be the existence of better adhesion, longer life, optically properties of optically clear adhesive replacement and elimination of traditional optically clear adhesive.

For example, the traditional OCA has many shortcomings and limitations: difficult to rework, requires cross-cutting, poor gap-filling effect on uneven surfaces and so on. New OCA epoxy resin type, acrylate type, silicone type and other categories, can better solve the above problems.

Because OCA in the field of materials with difficult to replace, and in the long-term monopoly of foreign enterprises, OCA present a very high profit margins (industry gross margins are generally above 40%). In recent years, Chinese companies have tried to layout this business.

According to JD Capital's research, Chinese enterprises' layout of OCA can be traced back to around 2010. After 2016, the number of Chinese enterprises laying out OCA has gradually increased.

At present, the layout of optically clear adhesive Chinese enterprises are roughly divided into four categories:

1, Film plants (such as release film plants, etc.) extend the optically clear adhesive business downstream. Release film is an upstream raw material for optically clear adhesive. Compared with the release film, optically clear adhesive localisation rate is lower, higher profit margins.

2, Tape companies expand categories horizontally. This type of enterprise itself is a functional tape manufacturers, horizontal expansion of categories (optically clear adhesive is also glue) is relatively easy. In the optically clear adhesive enterprises, this kind of background is the most companies.

3, Die-cutting factory extended upstream optically clear adhesive business. Die-cutting factory in the industry chain has a higher right to speak, often has better customer resources, the scale is not small. Downstream module factory and the terminal can choose the die-cutting factory is usually fixed, and the upstream optically clear adhesive enterprises also have to go to maintain the business relationship with the die-cutting factory.

4, Established through the acquisition of the original optically clear adhesive enterprises or business units. These companies usually have complete production equipment, perfect patented technology layout, and deep customer resources accumulation.

Almost all of the above enterprises are deeply ploughing in the upstream and downstream industry chain of optically clear adhesive, but the capacity of small scale, low visibility is their common characteristics.

2.Demand drives innovation, patents build barriers for giants

In the field of optically clear adhesive, is there a chance for Chinese companies to catch up with foreign companies? Let's take a look at the rise of several international giants and the current status quo.

1. 3M Group

Full name is Minnesota Mining and Manufacturing Company, founded in 1902. 100 years, 3M has developed more than 60,000 kinds of products (equivalent to an average of 1.7 new products per day), from household products to medical products, from transport, construction to business, education and electronics, communications and other fields.

Behind this is its innovation mechanism at work: In 1948, 3M introduced the "15% rule" - researchers can devote 15% of their working time each week to research on their interests. Many of 3M's best-known products, such as post-it notes, Scotchgrad waterproof fabric and microporous medical tapes, and improved tape production processes, come from the "15% rule."

In addition, 3M awards "Genesis Grants" of up to $100,000 annually to company scientists engaged in research. The company also stipulates that 30 per cent of each division's sales should come from new products introduced in the last four years.

Obviously, 3M's optically clear adhesive business is inseparable from its innovation mechanism.

2, Mitsubishi Chemical

According to the report of the consultancy CINNO Research, the Chinese market in 2020 optically clear adhesive material shipments ranked first for the United States 3M, followed by Japan's Mitsubishi (Mitsubishi).

Mitsubishi Chemical Group is Japan's largest chemical company, by Mitsubishi Chemical Corporation and Mitsubishi Oil Chemical Corporation merged in 1994. Mitsubishi Chemical Group official website shows that its history can be traced back to 1678. Currently, Mitsubishi Chemical Group's business areas cover chemicals, industrial gases, health care, etc., and optically clear adhesive is one of its important sub-businesses.

Even as the world's second largest supplier of optically clear adhesive materials, Mitsubishi Chemical is facing difficulties.

In 2021, Mitsubishi Chemical filed a lawsuit with the Seoul Central Court in South Korea, claiming that based on the patent rights belonging to Mitsubishi, requesting the Korean company TMS to stop the production and sale of OCA optically clear adhesive activities in South Korea, and make compensation.

This lawsuit involved the core process of the patented product of optically clear adhesive, which is the optically clear adhesive being After Cure by UV (ultraviolet light) after lamination of the cover material. This patented optically clear adhesive product is considered to be the industry's first after cure OCA.

3、Samsung SDI

Samsung SDI, is one of the subsidiaries of South Korea's largest multinational conglomerate - Samsung Group in the field of electronics, founded in 1970, is mainly engaged in the R&D, production and sales of small lithium-ion batteries, automotive batteries, ESS, and electronic materials related products.

In 2018, Samsung Electronics (another subsidiary of the Samsung Group) has announced the global launch of its first foldable smartphone, which has an optically clear adhesive supplier within the handset, Samsung SDI. According to media reports, Samsung SDI began working hand-in-hand with Samsung Electronics to develop the product around 2013.

Because of this, Samsung SDI claimed that it had successfully developed the world's first optically clear adhesive designed for foldable mobile phones, and that it had taken a leading position in the foldable mobile phone market.

From the development path of the optically clear adhesive business of 3M Group, Mitsubishi Chemical, and Samsung SDI, we find:

1, Optically clear adhesive is a supporting material for the upgrading of electronic products, and the head of the field of optically clear adhesive companies, most of which are chemical giants themselves, their underlying basic research is strong. Driven by the demand brought about by the rapid development of the electronics industry, these companies opened up or acquired the optically clear adhesive business, and expand it.

2, It is not impossible for Chinese enterprises to break the monopoly of foreign enterprises, but there are many difficulties.Especially in the field of optically clear adhesive, patent is an extremely important, and difficult to break through the giant blockade of the topic.

In the production process, the optically clear adhesive curing process is very important, which determines the product yield and stability. Optically clear adhesive curing method, mainly divided into UV light curing and hot curing.

UV light curing, refers to the LED ultraviolet irradiation, UV coating internal photoinitiator stimulated into free radicals or cations, thus triggering the active polymer-containing materials ( e.g. photosensitive resins ) to produce crosslinking polymerisation reaction, so that the UV material to achieve rapid curing;

Hot curing, refers to the different substances in the heating or in a certain temperature of the environment of the chemical action, and produce curing.

From the point of view of the curing effect, the use of UV light curing glue high transparency, adhesion, fast curing speed (within seconds to complete the curing), suitable for assembly line batch operation, you can greatly enhance the efficiency of the work; hot curing of the glue adhesive, is better in the flexibility and adhesion performance.

Although UV light curing consumes low energy and is fast, the disadvantages are obvious, such as some shadows or opaque areas cannot be cured; while hot curing, despite its good applicability, also has the disadvantages of slow curing speed and high energy consumption.

In the process of contacting a large number of enterprises, JD Capital found that some domestic optically clear adhesive manufacturers have achieved technological breakthroughs in hot curing, but it is still difficult to break through the patent protection scope of international giants in UV light curing.

3.With the opportunity of domestic substitution, companies that meet multiple competitive factors may be able to rise quickly

Fundamental innovation in the materials field has always been very difficult. A technology is full of uncertainty from the time when it is invented to the time when it is actually implemented on a large scale, which can be as short as ten years or as long as several decades. This process can also involve a lot of technological innovation, leading to changes in the competitive landscape for companies.

On the contrary, we believe that in some of the commercialisation path has been relatively smooth, relatively high technical barriers in the field of materials, Chinese companies through the foreign giants, whether learning or imitation, once the product is made, the speed of achievement may be relatively faster.

In some way, optically clear adhesive is a typical representative of the latter. It appeared in the 1990s and began to have large-scale applications after 2000.Especially in recent years, under the influence of trade wars and the new crown epidemic, optically clear adhesive has ushered in the opportunity of domestic substitution.

However, at present, if Chinese enterprises want to take off in the optically clear adhesive market, they still need to go through and fight a tough battle.

The first is the production process and technology patents mentioned above.

Second, is the overall process qualification, in addition to obtaining the end brand certification (adhesive performance verification), the optically clear adhesive process also involves the placement machine, defoamer, UV assembly line, etc., adhesive and customer production equipment matching is also very critical.

Third, is the richness of product categories and synergies, which depends on the enterprise's R & D capabilities and long-term accumulation, but also the domestic optically clear adhesive enterprises to enhance the competitiveness of the difficulty.

Fourth, is the price-performance ratio.

Divided according to the brand characteristics and life cycle of end-use products, the optically clear adhesive industry has three market segments: new machine, white brand (no eye-catching brand logo), and rework. Their market size and quality requirements for optically clear adhesive in decreasing order.

Previously, Chinese companies focused on white brand and rework market, and very few companies can enter the new machine market. The new machine market is monopolised by international giants, and the reason behind this is that apart from the fact that optically clear adhesive belongs to the top of the pyramid of the adhesive film industry, which has extremely high technical and patent barriers, there is another important point: for brand terminals, the unit cost of optically clear adhesive products is not high.

According to the research of JD Capital, the price of foreign optically clear adhesive products is 150~300 yuan/square meter, and the price of domestic optically clear adhesive products is 30~80 yuan/square meter. Although it is quite cheap, from the perspective of the whole industry, a square meter of optically clear adhesive can stick about 50 mobile phones/15 tablet PCs/10 laptops. It can be seen that the cost of optically clear adhesive products per unit is only a few dollars or even less.

Therefore, the brand terminal in the past is difficult to have the incentive to change suppliers, basically preferred international brands, because of its stable product performance can reduce the cost of trial and error.

Nowadays, under the general trend of domestic substitution, as well as in pursuit of supply chain stability, coupled with the intensifying cost competition, brand terminals are gradually inclined to choose more cost-effective domestic optically clear adhesive products.

JD Capital learnt that in 2021, a domestic enterprise has replaced 3M through product price-performance competition to become the first major raw material supplier of optically clear adhesive for Amazon Kindle e-reader, occupying 80% of Kindle's market share.

The ability to provide cost-effective optically clear adhesive products is the key to the breakthrough of Chinese enterprises. The focus behind it lies in the production cost control of the enterprise.

This brings us back to the topic of production processes. From the point of view of the production process of optically clear adhesive, the production cost of products using hot curing is about 20% higher than UV light curing. In the future, who can make technological breakthroughs in the UV light-curing process, who can further reduce the production cost of their optically clear adhesive products.

Fifth, the business relationship is also key. This determines whether each enterprise can go all the way through all the partners in the industry chain and eventually take key customers.

From the perspective of the commercialisation cycle, the time for optically clear adhesive products to obtain terminal brand certification is about half a year, and it takes 4 to 6 months for the products to be successfully introduced into the terminal brand, and 1 to 2 years for the products to be introduced on a large scale. Therefore, a company from the beginning of the layout of the optically clear adhesive business, to the formation of this business scale, at least 2 ~ 3 years.

In other words, the optically clear adhesive business can not be in the short-term volume. In this regard, enterprises and investors need to have enough patience.

Overall, in the field of materials, innovation is the driving force. Although costly and time-consuming, but if Chinese companies can do it first in the direction of domestic substitution, and then through the cost advantage and market advantage to live and strong, get sustained profitability and stable cash flow, it is possible to get a sustainable curved road to overtake the opportunity.

More informations about JD Capital’s insight in new materials industry:PE investment in new materials, how to avoid "a shot in the dark"?